Contact Our Experts

Phone

9821 488 489

info@loanz360.com

Other Loanz

Other Loanz

For More Details

Call Us

9821 488 489

Upto 100 % Cash BackOn Processing Fees |Zero Collateral | Easy Documentation | Competitive Rates | 20+ Best Deals

Bill Discounting

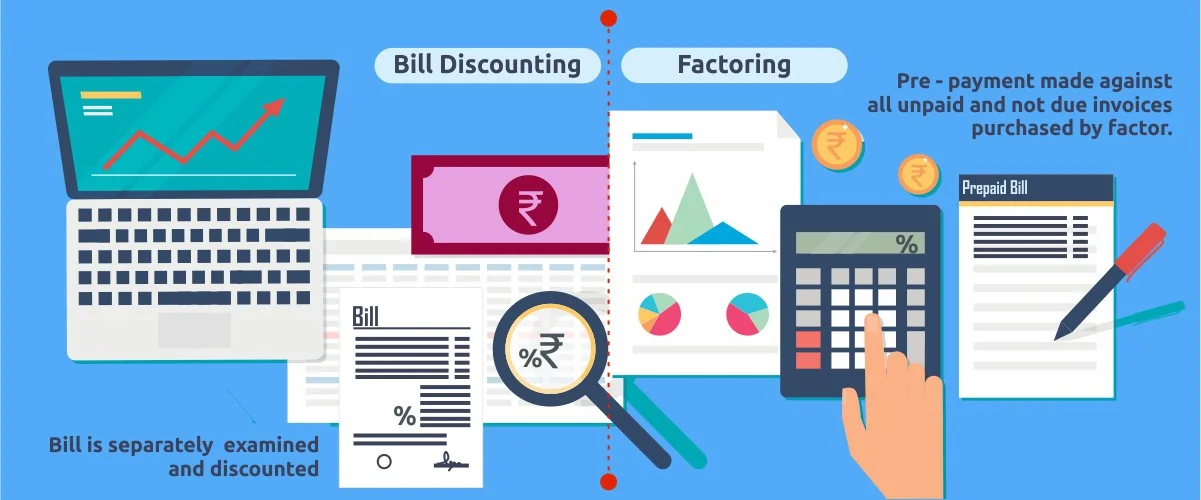

When a business needs urgent funds and its cash is tied up in bills or invoices, then the bill discounting or invoice discounting loan is given by lenders to save traders from the negative cash flow situation. Invoice factoring loan has quickly become a popular financing option for small businesses. This type of loan allows businesses to borrow money against the value of their outstanding invoices. This can be a great way to get the cash you need to keep your business running smoothly.

Bill discounting is also a handy way for traders to get paid for their invoices, even if they’re not due until a later date. Instead of charging a commission, the trader can sell the invoice to a lender, who will then purchase the promissory note before it’s due and credit the bill’s value to the customer’s account.

Simply put, if your business is facing a financial storm and is finding it difficult to keep up with unpaid debts and late payments, a bill discounting facility could help stabilize your business during periods of financial turbulence. By allowing you to sell your unpaid invoices to a third party at a discounted rate, you can free up much-needed cash flow to keep your business afloat.

Offering companies the ability to sell their invoices at a discount to a factoring company to receive an immediate cash injection, bill discounting can provide your business with the working capital it needs to stay afloat during tough times. Not only does this type of funding give you access to much-needed cash, but it also provides a safety net during periods of financial instability. So if you’re struggling to keep up with unpaid debts and late payments, don’t hesitate to consider this life-saving option. This would enable your business to remain focused on its goals and growth, even when revenue is unstable.